Disclosure: This post may contain affiliate links that earn me a small commission, at no additional cost to you! See our disclaimer for details.

What is the $10,000 Money Challenge?

Are you excited to start the $10,000 money challenge?

Money challenges are a great motivational tool when you are trying to build a habit of spending less or if you are trying to save up money.

The 52 week $10,000 challenge is more difficult than a few of the other challenges that I have tried, including the 52 Week Envelope Stuffing Challenge and the 365 Day Nickel Challenge. In this article you’ll find references to many of the other money saving challenges that I love!

So, what is the $10,000 money challenge?

The $10,000 money challenge requires you to save $10,000 in one year by following a money saving chart and depositing a specific cash amount each week.

As you will see later in this article, there are a handful of different ways to do this money challenge. For example, there is a method where you deposit money once a week and there is another way by depositing a specific amount twice a week. Also, there is another method where you deposit a randomly set amount each week, compared to another method where you deposit the same amount each time.

There is no perfect way to do the $10,000 money challenge. However, the whole point is to end up with $10,000 at the end of the year!

Be sure to scroll down to download your free PDF of the $10,000 money challenge!

How to Save $10,000 in 52 Weeks

Saving $10,000 in one year is a advantageous goal. Due to this, I recommend the following helpful steps if you are going to take on this money challenge.

Step #1: Get an Accountability Partner

Before starting any money challenge it is always recommended to get an accountability partner!

An accountability partner is someone who you must regularly check in with. This can be a spouse, partner, friend, or family member. You can choose if you meet with them once a week, once a month, or once a quarter.

Your accountability partner meeting could be in person or simply over the phone!

Having an accountability partner requires you to continue working toward your goal. By knowing you will have to meet with someone soon, you are less likely to give up or stop the money challenge.

Step #2: Have a Written Goal

It is important to have an end goal or why you are saving $10,000 in 52 weeks.

Maybe you want to finish paying off your student loans or your credit card. Or, maybe you are saving up for a home down payment.

No matter your reason for doing the $10,000 money challenge, be sure to have it written down.

Learn important financial terminology and get a set of free flashcards, here!

Step #3: Plan Ahead

Whenever you do a money challenge that requires you to set aside money each week, it is always important to plan ahead.

How do you plan on getting the money? Do you plan on saving more money or earning more money? Do you plan on getting an extra job or starting a side hustle?

These are all important questions to consider when it comes to starting a challenge like this!

When it comes to saving $10,000 in a year, it requires you to set aside anywhere from $50 to $300.00 each week. This can be overwhelming for some people who do not earn a lot or for families without a lot of wiggle room in the budget.

Therefore, be sure to check in with yourself to see if this money challenge will be realistic for your financial situation!

Different Ways to do the $10,000 Money Challenge

There are a handful of ways to do the 52 week $10,000 money challenge. Below I will go through three different popular ways to successfully save $10,000 in one year.

Method 1: 52 Randomized Weekly Deposits

This first method typically is set up in a bingo-style layout. It typically involves a printable money saving chart that has 52 randomized numbers throughout the chart.

This version of the money challenge requires you to color in or cross out an amount each week. For example, 1 square might have $60 and another square might have $250. other squares might have $90.00, $125, or $300.

The idea is to pick a square for the week of an amount that you realistically could earn or save extra money in order to deposit.

one great benefit of this version of the $10,000 money challenge is that you have more control over how much to save that week. If you are busy and don’t have as much time to do a side hustle, you have the ability to choose a number that is lesser in the amounts.

Method 2: Set Deposits Each Week

The 2nd money saving chart to save $10,000 is to deposit a set amount of money into your savings once or twice a week.

Having an expected amount to deposit may be good for individuals who may be anxious about saving more money one week compared to the next.

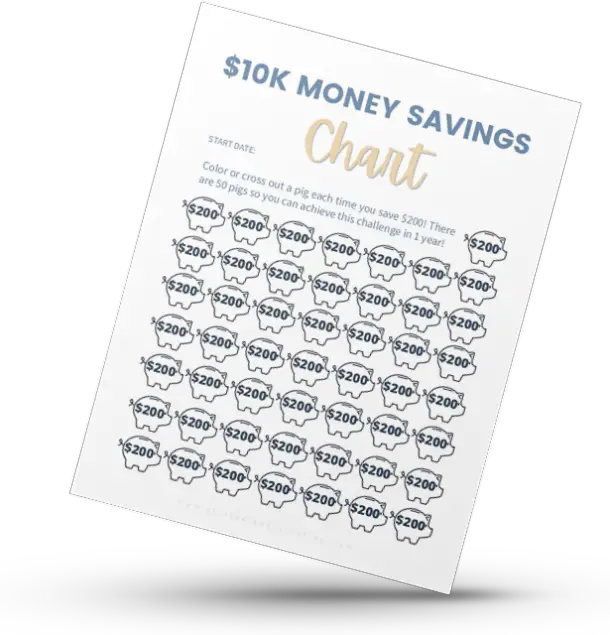

To do this version of the money challenge, you would need to set aside either $100 twice a week or $200 each week for a year!

It is important to note that this specific method of saving up $10,000 in a year does add up to be $10,400, so it can be ended 2 weeks sooner than the other challenge versions.

Method 3: Interval Weekly Deposits

The 3rd way to save $10,000 with a printable money chart is to do an interval savings method.

This means that you would save a specific amount on week one of the month, another amount on week two of the month, a different Mount for week 3, and another four week four.

This version is a mix between the first and second methods because it involves some amount of predictability and is still a challenge to earn and save more week by week.

This money savings chart works by saving $125 on week 1, $150 on week 2, $175 on week 3, and $300 on week 4. Repeat for each month of the year!

$10,000 Money Saving Chart

Download 52 week money challenge PDF to save $10,000 this year!

When you enter your email to get your money saving chart you will automatically get access to the free PDF. Additionally, you will be added to a bi-monthly email list that will give you a free printable twice a month!

7 Ways to Earn More Money for This Money Challenge

In order to make extra money, you need to put in the extra effort! However, when you’re doing this $10,000 money challenge, making more money can expedite this process! If you don’t have the time to work a second job, consider these alternative options to making money on the side!

- Facebook Marketplace: Sell items that you find at garage and estate sales, or simply get rid of items of your own!

- Survey Sites: Apps like Swagbucks and SurveyJunkie are great recommendations to make extra cash each month, in the form of giftcards.

- Drive for Uber, Lyft, Grubhub: Being a driver for a delivery service has become a popular way to make extra cash!

- Sell Clothing to Poshmark, Mercari, eBay: Reselling garage sale or used clothing items on these apps can be a good way to make cash on the side!

- Do Chores for the Elderly: If you are looking for a way to help in your community, doing chores like lawn mowing, cooking meals, laundry, or even gutter cleaning can earn you extra side income while being a help to those in need.

- Homeschool Assistant/Tutor: Use your skills or knowledge and make extra income on your weekends or in the evenings by being a tutor or homeschool assistant! There are free apps you can use to market yourself for this opportunity!

- Update Furniture: Even if you aren’t skilled in handiwork or carpentry, this income opportunity is still possible! Purchase used furniture or find items at garage/estate sales. Follow YouTube instructions for painting or updating the furnish on a piece and resell!

4 Ways to Save Money for This Money Challenge

Don’t have extra time to earn more cash? Save more money with these unique ideas!

- Cancel Your Subscriptions: Save cash by quitting your subscriptions for pet toys, makeup, food, or even streaming services!

- Meal Prep: food is typically one of your highest expenses each month! Save hundreds bye not eating out and meal prepping instead! Learn more here!

- Renegotiate Rates: A unique way to save money is to negotiate ratesFor example, insurance, cell phone, and cable bills can be negotiated to lower rates. This is an awesome way to save money month by month to start adding to your savings

- Stop Buying Materialistic Items: Keeping up with the Jonses is a real issue for many of us, especially if you are doing the $10,000 money challenge! But, if you want to stray from making unnecessary purchases during this time, you may need to stop comparing yourself to others and start being okay with what you own!

More Money Challenges

Are you interested in more fun ways to save money? Check out these other popular money challenges to try out!