Disclosure: This post may contain affiliate links that earn me a small commission, at no additional cost to you! See our disclaimer for details.

What path have you chosen to achieve F.I.R.E.?

Investing in real estate has increasingly become more popular as an option for “everyday people” like you and I to achieve financial freedom.

But, the question we always hear is, “How do I start!?”

In this article I am giving you all the details. Every step that I have gone through from day 1 to where I stand at time of this article publishing.

You’ll learn about how I originally learned about rental investing, how I bought my first property, how I invested into a rental, and everything in-between!

Investing in rental properties is a very REAL way to quickly earn passive income and expedite your financial journey!

In this article you’ll learn how to begin your own investing portfolio!

Related Articles:

Why Real Estate?

My financial journey started in 2017 after coming across a popular finance book called “Money Master the Game”.

This book opened my eyes for first time about how money worked – and the importance of understanding it.

Fast forward a few months and Scarlett and I started attended Dave Ramsey’s Financial Peace University course at our local church. This class is a great place for any beginner to learn about money, and it motivated us both to start being serious about our money.

Yet, I went against Dave’s advice and purchased a car, adding $18,000 of debt to my name. Not soon after, I had a sickening feeling about this debt. I had to find a way to pay off a massive amount of money without an increase of pay or a raise. In addition, I recently was trying to save for an engagement ring.

I had to be serious about my money.

At this time I had a mental shift. My hobbies changed from hunting to career development and learning about finances. Sounded boring to everyone else, but something had to be done to get rid of this debt. I was not ready to start a life with my wife and burden her with thousands of dollars of my debt.

I then found “Rich Dad Poor Dad”, a popular book that many people who are new to personal finance reads. It’s a clever yet life-altering book that will make you realize how the rich view money. Through this I learned about real estate investing – a concept that I never thought was available to a mid-20’s middle class American.

With this became my obsession of learning about real estate investing.

How to Learn About Real Estate Investing

There are four specific ways that I learned about rental investing – and all are ways that you can too!

1. Audiobooks

I got Audible early in my journey and I continue to use it daily. It is such an easy way to learn while in the car, while exercising, or when doing house projects. At the time of this writing I have listened to over 50 books on this platform alone!

Below is a video recording from my Audible account, showing many of the books that I have read.

2. Podcasts

I cannot emphasize the importance of learning from podcasts, and how impactful they have been in my journey to our first rental investment. There are dozens that I have tried out, but some of my favorite include:

- Bigger Pockets (they have multiple podcasts that I regularly listen to)

- Mad Fientist

- Paula Pant

3. Pick Brains of Someone with Properties

It is highly likely that you have met someone who owns rental properties. Scarlett knew of an older woman who owns a few properties, so we sat down one evening to learn everything we could.

This was very helpful because we were able to learn about do’s and don’ts, basic things to look for in houses, and areas of town that she invested in. It was a great place to begin.

We actually ended up doing many things different than she suggested with our first rental, but it was very helpful to discuss this with someone who had experience!

4. Learn from a True Investor for F.I.R.E.

I was lucky to come across a young lawyer who had 40 properties. I asked to meet with him at a local restaurant to learn all about his goals, methods, and strategies, and I was glad that he accepted.

This was different than meeting with the woman as mentioned above, because the lawyer was investing for F.I.R.E. Plus, it is a whole different experience when you discuss this with a young investor!

Ready to find rental deals in your area? Download DealCheck for free or get 25% their premium service with our special code VIP25OFF!

Our First Property (Sort Of)

During our first house search, we did not know about house hacking so Scarlett and I generally looked specifically for a home that would be good for a rental.

It was an incredibly hot market but we finally found a home that didn’t sell within 12 hours (like the rest of them) due to a terrible listing. It was a townhome, attached to another townhome, so the structure looked like a duplex. Only one of the units was for sale. It was listed for $115,000. We got it under contract for $112,500 with $2,500 from seller towards closing costs. Thankfully I had worked on increasing my credit score and easily got a conventional loan for this home.

We purchased this home ORIGINALLY with the intent of moving out within a few years and renting it as our first rental property.

However, at closing we found out that the owner’s sister owned the attached townhome. It would be up for sale soon!

Yet, this wasn’t necessarily good news. More on this later…

We did get a home inspection and radon test, but no termite inspection. Unfortunately as we removed some wallpaper for cosmetic updates, we found termites.

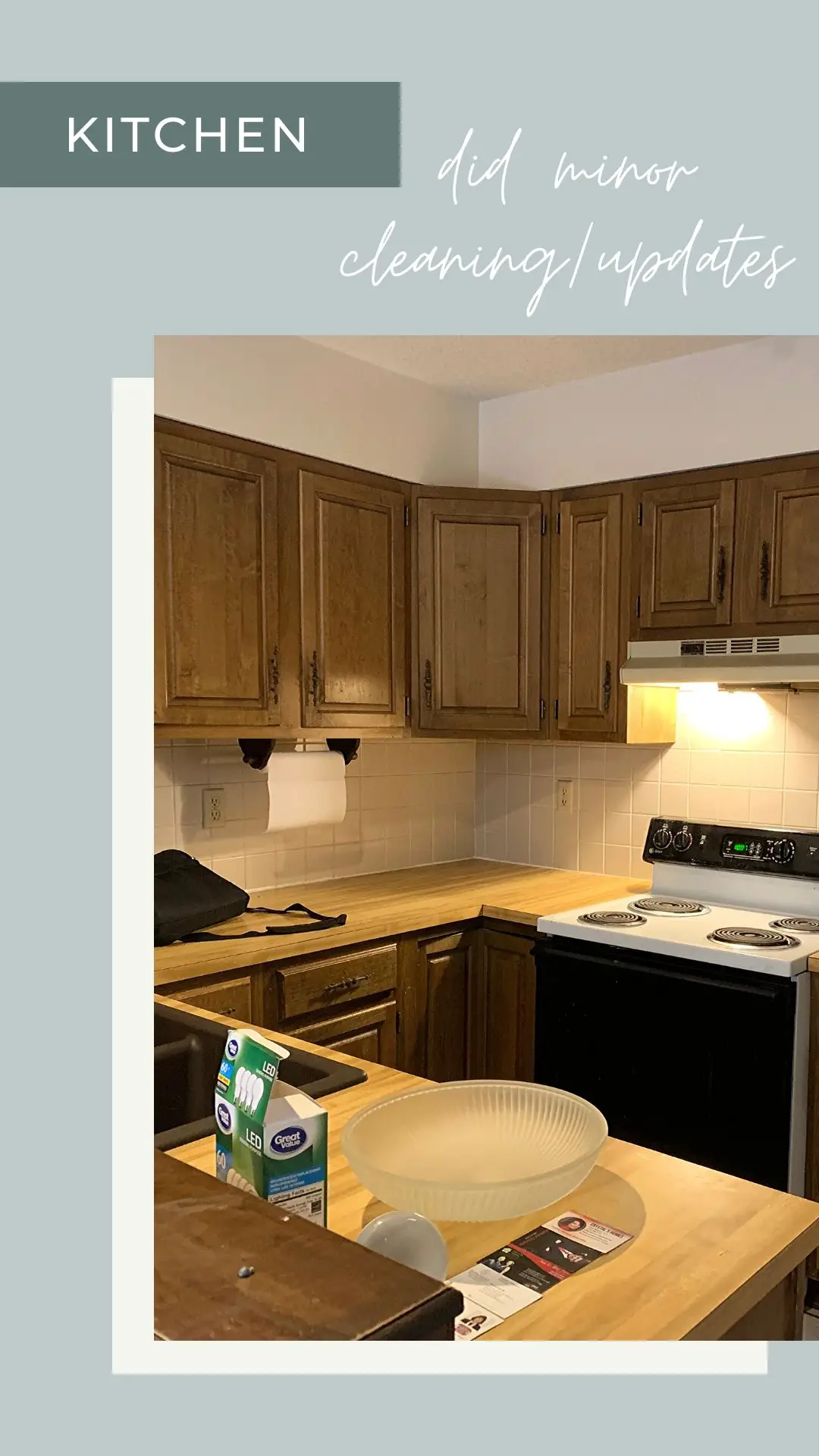

Since purchasing this first home, we have updated some minor details to increase for future rent and for longevity purposes, including: door handles, termite removal, ceiling light fixtures, and dead tree limb removal.

This is the home Scarlett and I are currently living in until we have enough for a down payment for a house hack. Keep reading to learn about our ACTUAL first rental property!

Our REAL First Rental Property

How It Began

We learned that our next-door home’s seller had inherited 16 properties and was selling this one to pay for her daughter’s wedding. What was interesting though was that it had been on the market for MONTHS, even despite the current hot market at the time.

Considering we just bought a home, we did not feel comfortable suddenly buying a second property – nor did we have the funds to do so!

I toyed with the idea though. I continued to learn about rental investing, and I requested a walk-through of the property.

It was in rough cosmetic condition, and it had not been lived in for months by this point.

I did get the opportunity to chat with the seller’s agent. He managed 200 properties, including 50 of his own. Unfortunately our agent at the time was not experienced in rentals or investment properties due to being new to real estate (not someone I’d advise you hire), so learning more from the seller’s agent was priceless.

So, the house was listed for $119,000. At first we lowballed with an offer of $86,000. I figured that, after months of having no offers, it would be good bait.

It didn’t work, so I decided to offer $90,000. Still, no luck. I held my tongue and offered $100,000.

At this point I had no idea if this was the right thing to do. I was not even sure if I could afford to put down a downpayment!

Buying the Rental

To be honest, I was fairly stressed during this time. Between doing extensive research about investment properties (I had to make sure I was doing things right!), figuring out how to pay for the property, and my W2 job, there was a lot going on.

I was working through the preapproval process with a lender but I didn’t realize the property required more documentation since it would be a rental. In a frenzy of confusion, they recommended I liquidate my 401k for the down payment. YIKES.

But, Scarlett and I still thought that considering the termite situation, it would be good to own the second half in order to maintain the integrity of our side of the property.

I made a list of repairs and determined that I would need 30k for this house to be rent-ready, which included the down payment, closing costs, and repairs. Thankfully I ended up finding private funding for assistance for the down payment, along with successfully getting approved for a loan due to my good credit score.

To add to my worries at the time, the seller notified me that there was a cash offer ready to be accepted – unless I would agree to a $110,000 offer within 24 hours.

Making the Property Rent-Ready

We agreed to purchasing the home at $110,000. I had reached out to a property management team that was recommended to Scarlett, and signed on with them.

We named this property “The Ugly Duckling”.

They had a make-ready team that did repairs for much cheaper than I originally calculated, which eased some worry. Scarlett and I personally did some vacuuming, wall washing (there was food splattered everywhere in the kitchen), and basic cleaning of the house, which cost only around $200. We then had the management company update the bathrooms, install a refrigerator, deep clean the carpets. This cost an additional $2,500, but was less expensive than had we done the work ourselves. $500 went toward additional updates after the tenant moved in.

We rent for $1050 and have cash flow each month.

Property Analysis

Our Current Property

The property that we lived in is great because we pay less than if we lived in an apartment, and we plan to rent it out within the next year as we search for a house hack. We continue to do minor updates to be able to rent for higher come that time. Thankfully these two properties are in a high-appreciation suburban area, next to a school, gym, and retail.

During our year of buying these two homes, we’ve gained TONS of knowledge in home maintenance, repairs, negotiating, lenders, expectations, and more.

Our Rental Property

We have enjoyed owning this property over the past year. Since it is next door, we can easily keep an eye on the home.

Now, yes, looking at the numbers, it really isn’t the BEST deal out there. Additionally, many argue that we should not use a rental management company to save money.

Yet, without the management company, it would have taken longer to get rented, we would have spent more on repairs, and the tenant would not be as satisfied.

The property does cash flow and considering the area, it is expected to increase in rent over the years. Plus, with our tenant next door it is similar to getting the feel for our next property which will be a house hack (living next to your tenants).

Overall, we truly have gained tons of knowledge. It is common to hear that the first rental is always the hardest because you have no idea what you’re doing.

We look forward to sharing our story about our next rental investment!