Disclosure: This post contains affiliate links. If you click through a link and make a purchase, it will earn me a small commission, at no additional cost to you! See our disclaimer for details.

Are you planning to retire early? Are you in your 20s and are interested in investing with real estate? Well, you’re in the right place!

You’ve been thinking to yourself, “Everyone else is able to do it, why can’t I?”.

Real estate investing has exponentially grown in popularity and it is being considered one of the easiest ways to achieve financial freedom. It’s no wonder that you’re wanting to learn a bit more!

But, there’s a lot to learn.

Before getting my first property, I had no idea what I was doing and there were a lot of differing opinions about rentals!

- Is it smart to buy a rental when I have student debt?

- How much do I need for a down payment for a rental?

- Who can I go to for investing advice?

- Do I have to do all the maintenance on the house?

With any form of investing, you have to do your research first. I created this guide to take you through all the major aspects of rental investing and point you in the right direction to buy your first property! Don’t be like me and try to learn as you go – read through this article and learn as much as you can!

In This Article You'll Learn:

-

Why You Should Invest in Real Estate

- The 3 Steps to Learning About Rental Investing

-

4 Ways to Succeed as a Young Investor

-

How to Buy Your First Rental Property

Why You Should Invest in Real Estate

1. Ultimate Passive Income Opportunity

The best way to achieve financial independence is through passive income, plain and simple. With rental investing, you get cash every month, and this drastically increases with more properties!

2. It Doesn’t Require a Degree or Real Estate Licensing

It doesn’t matter if you are young and have student debt or if you are wealthy and want security with your investments. The great part about rental investing is that ANYONE can learn about it and can achieve financial freedom with it. You don’t need a degree to invest in rental properties!

3. It is Easier to Understand than Other Investing Methods

How much do you actually know about stocks, bonds, and mutual funds? The great part about rental investing is that it is easy to learn and has pretty immediate payouts compared to other long-term investing strategies! As we will discuss later on all you need are a few free apps like DealCheck and be willing to learn!

FREE RENTAL INVESTING COURSE

Get free access to articles and videos and learn everything you need to grow wealth as a new rental investor!

The 3 Steps to Learning About Rental Investing

1. Learn Your Area

The first, but necessary step to rental investing is learning what areas of town you want to invest in.

You need to start learning about:

-

Property values

You need to analyze different parts of your city or town, check out demographics and education levels, how much houses are renting for, and look for areas with both single-family and multi-family homes

-

How to calculate if a house is selling for a good price

One huge skill with rental investors is knowing how much a house should cost. This includes understanding price per square foot, brick vs siding, and even how much a home should be based on age.

-

Investment deals – Good and Bad

You need to be able to quickly calculate your return on investment (ROI), potential cash flow, and even potential costs you’ll encounter with each property.

Have any idea how to start learning all of this? No worries, I’ve got an easy solution!

I discovered the free app and website called DealCheck and it is a rental investor’s DREAM.

Before finding DealCheck, I used Zillow because I didn’t know any different and I’ve never opened Zillow since!

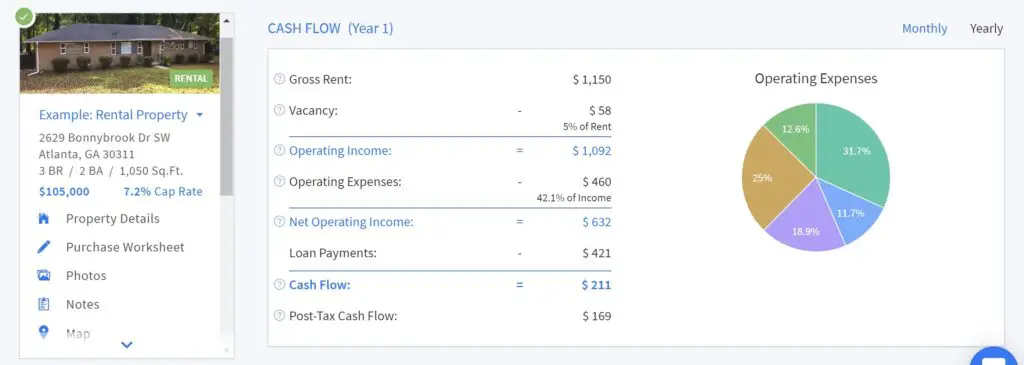

This app is the easiest way to start learning about homes! In the below screenshot from my DealCheck profile, it shows the potential cash flow from a property.

Go sign up for free now and use what you learn in this article to start learning about rentals on there. You won’t regret it!

2. Get Your Money Figured Out

Boost Your Credit Score

No matter how you will end up funding your first rental property, it’ll probably be a number of months (or years) from now.

One of the most significant ways you can improve your chances for a investment property home loan is to get your credit score up now. Credit scores take awhile to improve and you’ll be frustrated if you get rejected from a loan application all because of your credit score!

I personally use Credit Karma because it is free and checking my score has no effect on the score itself!

For in-depth information on this, check out my article about quickly boosting your credit to buy a house!

Track Your Cash Flow

Do you know how much you spend every month? Every week?

Whether you are a college student or have a family, you have cash flow, and you need to start tracking it right now.

Reason is, when you buy your first property, there are going to be all sorts of miscellaneous expenses and you need to have the habit of tracking your money established by then so you don’t mess up your taxes.

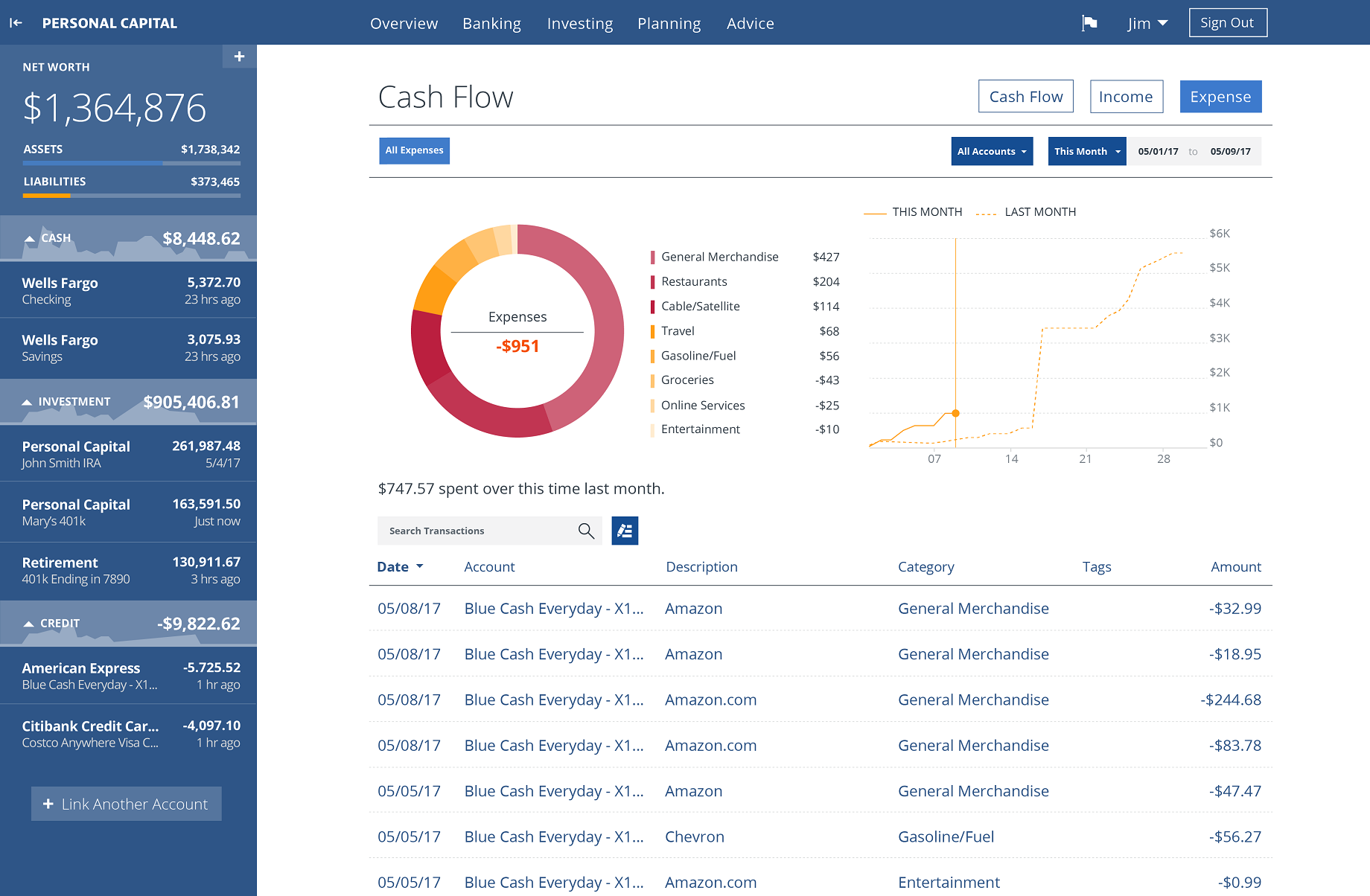

The easiest way to track your net worth, learn about budgeting, and analyze your cash flow is through the free software called Personal Capital.

I’ve been using this app for years, but make sure to add in all your liquid assets, loans, debts, and investment accounts to get your true net worth and cash flow amounts!

Below you can see an example of how to track your net worth and cash flow with Personal Capital!

Check out my detailed review here of Personal Capital!

Start Saving NOW

How are you going to fund your first property?

Some people save up to buy properties in cash and some only save up to pay the down payment.

If you’re like me and don’t have $90,000 in cash sitting around, you’ll need to learn to start saving money!

There are two easy ways to learn to start saving cash, and they can save you hundreds to thousands over this next year!

Acorns

I personally use this app to set aside money for investing in stocks, but you can use it to set aside money for your first property!

Acorns works by rounding up your purchases to the next dollar and reallocating those “cents” into a savings fund. It’s a way to save money without even putting thought into it!

Check it out here and get a FREE $10 credited to your account!

Surveys

What would you do with an extra hundred dollars a month?

Survey sites are the easiest way to earn extra cash in your free time – and save it up for your property!

Between working and the blog, I only have time to use two survey sites, but the two I use are reputable and easy to use! It’s at least worth checking out and seeing if you have an extra few minutes a day to earn cash and gift cards!

The two survey sites I regularly use are:

3. Learn About Home Loans and Mortgages

If you’re young, chances are you don’t have enough money to buy your first property with cash.

You’ll need to start looking into home loans, because getting a loan for your rental will be a little different than buying a personal home!

Instead of trying to set up appointments with banks, I suggest heading over to Lending Tree and taking a look at their simplified calculations for rental property loans!

With your free account you can:

- Learn how to get a home loan for your first property

- Refinance your rental property (you’ll learn later why this is so important!)

- Check prices for rental home insurance

Remember how I mentioned that research is critical for new investors? Lending Tree is how I learned everything about financing my property!

4 Ways to Succeed as an Investor

Investing in real estate in your 20s can look a bit different than the typical wealthy individual looking to make more money. The following tips will guide you to connect, network, and start growing as an investor, even before having properties!

1. Get an Accountability Partner

Who in your life is cheering for you, excited for your goals, and will pick you up when you fail?

Choosing an accountability partner or group is the single best way to gain motivation to invest and get realistic guidance.

Try talking to coworkers about their interest in investing or making a post on Facebook to see if any of your distant friends have interest in being a part of your journey!

2. Join an Investing Meetup

If you live in or near a city, investing groups or meetups are prime ways to get advice, meet potential investing partners, and find an accountability partner!

Go onto Google or Facebook and search for real estate investing meetups to see what’s offered in your area!

3. Find a Real Estate Agent Who Works with Investors

When buying properties, you’ll eventually need an agent. But buying for rentals is much different than buying for home – you’ll be looking at homes that are older, and potentially more worn than what you’re living in currently. Find an agent that knows what to look for and save yourself headaches in the long run!

One of my best tips is to go to open houses and chat with real estate agents about rental investing. Chances are they know of someone who works with investors!

For more, check out my article about how millennials can learn about rental investing!

4. Learn, Learn, Learn!

Investing a large lump sum of money is risky, so you need to know a thing or two about rental investing before you dump your money into potential failure!

My favorite ways I’ve learned more about rentals include:

- Books:

Go to your local library and pick up one of my favorite rental books, The Book on Rental Property Investing. It’s the perfect place to go to following the article and learn more!

Do you not have time to sit and read? Audible gives you one free book a month, so you’ll never have an excuse not to learn!

- Podcasts

The BiggerPockets podcast is my go-to for daily rental investing advice! They have over 300 episodes, so you will find something you are interested in!

%

Millennials who do not invest

How to Buy Your First Rental Property

There are plenty of strategies to buying rental properties, but one of the most proven and reputable methods is the BRRRR Method.

The basis of this strategy is to buy a fixer-upper home, make improvements, receive profits from a refinance, and then use those profits to purchase a new property. Let’s review:

Buy

First, your DealCheck app to look at properties that are priced below market value. This part is important for the “refinance” portion of this method.

Then, you can look at options for financing, including private money, personal loans (family, investing partners), or a loan from Lending Tree or a local bank.

Rehab

Following the purchase of your rental property, you’ll need to make some fixes to be able to get a good profit when you refinance. The homes you look for will need some fixes, but a few thousand dollars will go a long way when you refinance!

Rent

I personally rent through a rental management company, but you can find and manage tenants on your own – it all depends on how much extra time you have, and how much experience you have with home renovations!

Refinance

After approximately 6 months to 1 year, you’ll be ready to refinance! You’ll have the house appraised again and go through the refinancing process and the goal is to earn enough cash to have a downpayment for your next property purchase.

Repeat

This step is as simple as it sounds – repeat the process! The BRRRR method isn’t super quick, but it can work. Plus, realistically, you can’t expect to buy tons of properties each year. This method allows you to only put in money at first, and be able to use profits to buy additional rentals!

Summary

There is a lot to learn to start investing in real estate while in your 20s, but it will be so worth it soon!

- Start your research NOW! – Learn about your area, start scoping out real estate agents, and start reading books.

- Learn about finances! – Start discovering how much money you have to invest, seek out potential investing partners, and learn about home loans.

- The BRRRR Method – This method is a proven strategy that is helping young investors buy properties quicker than dumping all their cash into buying homes.

References: Yahoo Finance

Hi Scarlett,

Founder/CEO of DealCheck.io here – thank you so much for recommending our software to your readers. We’re always adding new features to make our property analysis tools even better and are looking forward to adding some cool stuff this year!