Thanks to Tom from Whatthefi.com for this guest post! Be sure to check out his blog information down below! If you are interested in guest posting on this blog, click here! Disclosure: This post may contain affiliate links that earn me a small commission, at no additional cost to you! See our disclaimer for details.

First Steps to Your First Rental

Overall our first experience with real estate turned out to be pretty successful for us. While I know most are interested in traditional methods of investing, we found real estate investing can substantially move the needle and have immediate rewards.

These are some of the benefits of real estate that you don’t get from traditional retirement investments:

- Depreciation

- Rental Income & Cash-flow

- Appreciation

- Tax benefits

- Exit strategies

- Leverage

There are more benefits (and drawbacks) that we could get into but I’m mostly going to focus on the nitty-gritty of our journey.

Ready to find rental deals in your area? Download DealCheck for free or get 25% their premium service with our special code VIP25OFF!

The Deal:

We decided our first rental would be single-family home (SFH) rather than a multi-unit and looked for 3 bed and 1 or 2 baths (note: 3 beds have better resale than 2).

We found a 3/1 SFH in a hot area for renters. The seller inherited the house and listed it below market, so we jumped on it immediately. Because we lived an hour away, our rock-star realtor face-timed the interior for us, and we made the offer without even visiting.

I don’t advocate making offers before you visit a property, but this was a case where we were very educated about the area and had a 5-day inspection to back out. Also, through much trial and error, we knew if we waited another minute it would have sold.

Details of the purchase:

- Market Value: $95,000-$105,000

- Asking price: $89,000.

- Offer & accepted: $87,000 (+ 1 year home warranty and $1000 credited for repairs).

- 20% down payment: $17,600 + $4000 closing fees=$21,600

- Cost to refurbish and make rent ready: $2,500

- Chase Ink CC cash-back rewards: +$500

- Total out of pocket for rental=23,600

Details for cash flow

- Rent= $1,330.

- Mortgage= $675

- Set aside Cap XVacancy= -$120

- Total Cash-Flow=$535!

- Total Cash-Flow for the year= $6,420

- Cash-On-Cash Return on Investment (COCROI)=+20%

If we continue down this path, in three years we will have made all our down payment money back on cash flow alone.

This doesn’t include the debt pay-down included in the rental income. Also, considering that we purchased a house that was pretty turn-key and we have tenants that plan on staying (so far) hopefully we may have extra Capx/vacancy funds. We have no plans on spending extra money as we may need it for a rainy day.

Granted, your first deal doesn’t always work out this way and we didn’t expect it to be this good. We just wanted to get some cash flow and use it as a learning experience. That being said we attribute our success so far to preparation, conservative calculations, great tenants and even better mentors.

Renters/tenants:

We learned the most important part of your investment isn’t the actual building itself, rather it’s your tenants.

Tenants can make or break your investment, so vet them accordingly and then treat them well.

Because our rental was in an area that had low crime, good schools and in high demand, we knew it would attract great renters that may accept top-rent asking.

On the other end, whenever they have an issue, we take care of it right away and are in constant communication. We even send them an Amazon gift card on the holidays to keep them extra happy.

Some investors unfortunately just try to get anyone in the door but this can lead to a huge mistake. We heard a lot of ugly stories about nightmare tenants that made life very unhappy for the investor.

Property Management

We assumed all along we would just hire a property manager (PM) so we could be hands-off.

But then one of our mentors, who handles all of his thirty units by himself, suggested we do it ourselves. He showed us that as long as you have good tenants it’s actually not that hard. He also explained that NOBODY will care more about your property than YOU will.

So, we gave it a shot.

We decided that we would take care of the communication/ management side and hire a handyman for smaller projects. We also found that there are TONS of resources to help landlords.

For example, there were at least 20 different management software platforms that help with communicating, advertising, accounting, and transactions. The hard part is picking just one. Currently, we use Cozy.co as it was free and we found it to be easy to manage.

I’ve also been recently experimenting with another free app called Stessa which does a great job organizing and tracking expenses on a nice spreadsheet. This was beneficial to us before we filed our taxes.

As a result of managing our own rental, we are saving an extra $1200 a year we would have spent on property management costs.

We found that being our own PM can be an invaluable learning experience that teaches us to be more hands-on. Through management, we discovered how to find good help, better communicate with tenants and how much materials costs so we know we’re not getting ripped off.

Mentors & Resources:

Lastly, I cannot stress how essential it is to have MENTORS familiar with the area.

You will be surprised at how generous investors are toward helping you. Our mentors were instrumental in helping us locate great deals, low crime areas, taxes, and hidden costs. That being said try not to bother them too much and, if you can, provide them with your own added value.

We also learned from Brandon Turner’s The Book on Rental Property Investing, it helps to find a realtor that not only knows the area but also invests in rentals themselves. Because our realtor was an investor, she understood we weren’t looking for a just a house, rather we were looking for deals that would make us profit.

Another GREAT resource to find mentors is biggerpockets.com where you can network with investors anywhere in the country online.

This was so helpful when we first started and led to us meeting like-minded people we still talk to today. It also has a ton of great resources including investor forums, REI articles, how-to find deals seminars, and tools like the investment calculator which we used for all our potential investments.

OUR TIMELINE:

I wouldn’t want anyone to think these were easy or quick steps. Nothing worth pursuing ever is. Altogether it took us about eight months from start to finish.

Here was our approximate timeline:

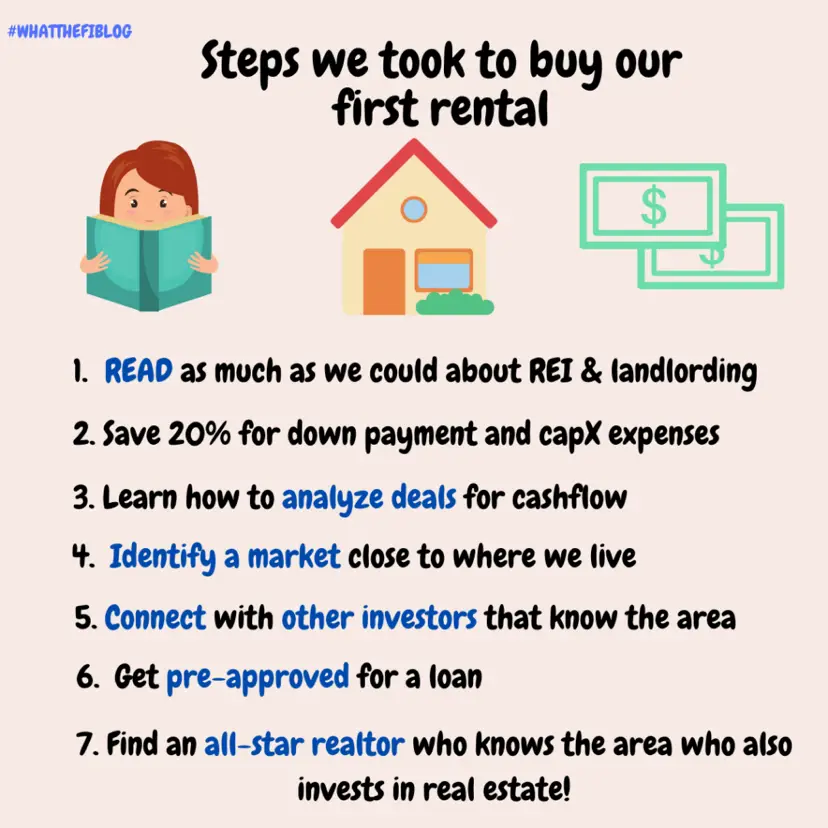

- Reading and learning about REI and land lording= 5 months

- Saving 20% down payment and CapX expenses= 1 year

- Learning to analyze deals and connecting with likewise investors= 3 months

- Identifying specific areas and making offers= 3 months

- Rejected offers=5

- Accepted offers=3

- Failed inspections=2

- Closing the deal= 1 month

- Clean & refurbish home to rent-ready=2 weeks

- Found renters= TWO days!

- Screened & vetted renters=5 days

- Renters moved in=20 days from closing!

So was it worth it?

All this may all seem daunting for some, and I know real estate isn’t for everyone. You certainly need the discipline and passion for this. That being said we felt it TOTALLY was worth it and are now proud to be called landlords and new investors.

My wife and I are excited to find rental #2 this summer. Our timeline, hopefully, will be faster, considering we are a little more experienced this time around. We decided our long term goal is to have 15 units before we retire.

Why not 10x our goals-right? 😉

-Tom B.

Tom is a middle school teacher and reborn FIRE advocate. He is the owner and founder of What The Fi? a personal finance blog focused on investing, budgeting, and finding life beyond living paycheck to paycheck.

Disclosure: This post may contain affiliate links that earn me a small commission, at no additional cost to you! See our disclaimer for details.