Disclosure: This post contains affiliate links. If you click through a link and make a purchase, it will earn me a small commission, at no additional cost to you! See our disclaimer for details.

Personal Capital: A Review

If there is one thing you need to do before budgeting, investing, and saving for your future, it is to understand your net worth!

Your net worth is simply how much money you have in assets and liabilities. As in, how much you have in the bank, in investments, in mortgages and debt, and in loans. It’s a snapshot of your entire financial situation!

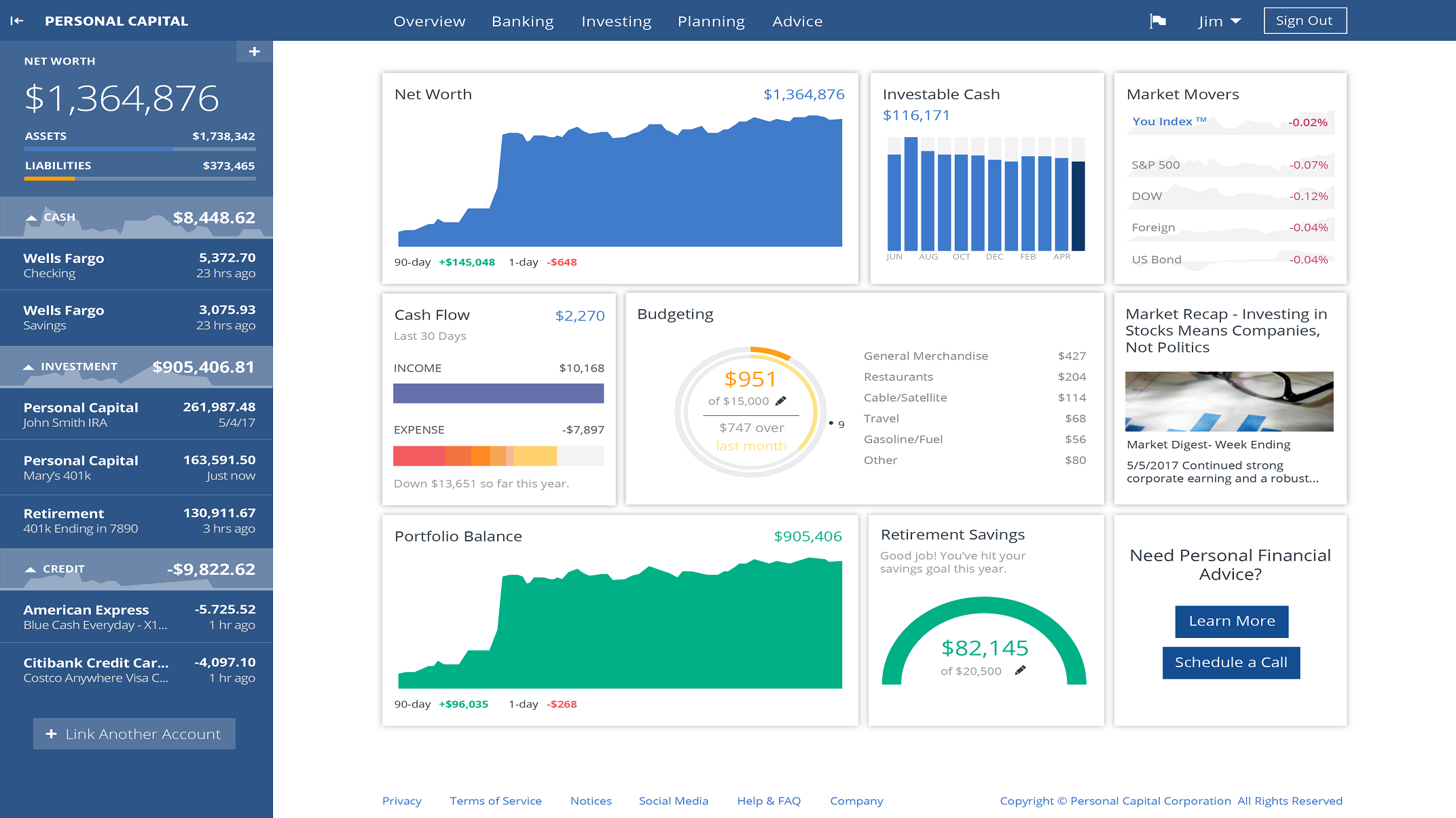

Imagine having the ability to open an app (or a website) and get:

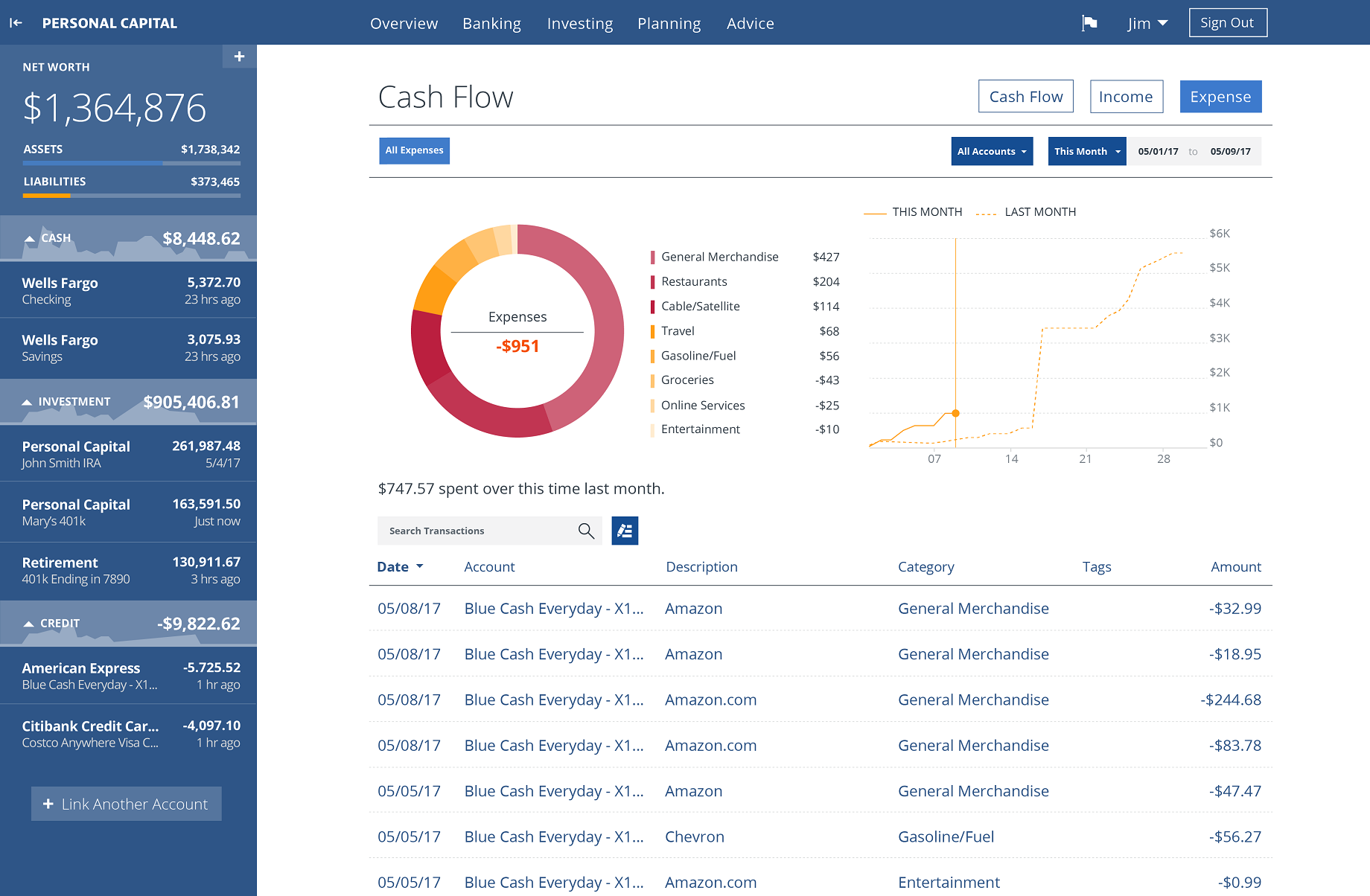

- An analysis of your month’s spending, allocated in categories and percentages, and your budget

- A personalized projection of your financial future

- A thorough explanation of your current and potential investments

For those of you who are new to this whole “personal finance” thing, this may not sound too intriguing! That’s understandable!

Personal Capital provides far more than any other service, and we recommend for you to check it out!

For this review, we’ve outlined the most important aspects of the app and desktop versions, provided graphics, and explanations of what you can get when you download the app or sign up!

If you have any questions, comment below! We’d love to create the most in-depth review to help our readers improve their financial journey!

Let’s explore the 7 ways we’ve evaluated Personal Capital!:

7. Price: FREE.

Seriously.

After having an account for what seems like forever, we’ve never encountered an attempt on their end to make money.

Now, there is a paid service for some financial advising, but you can take advantage of every single tool in the app without ever paying a dime.

And, you’ll never have to deal with ads or marketing emails.

This is what really set this app apart for us! Many apps that exist have paid versions to access all of their features, or to link more accounts.

Thankfully, this gem of an app is perfect, since you get beautifully designed graphics, quick customer service, and all their tools without needing to pay anything.

6. Ease of Use: Beginner Friendly!

This is a huge reason why we think you’d enjoy Personal Capital!

First, it’s easy to use, easy to access, and easy to maintain.

Second, you don’t need to consult a financial advisor to link your accounts, and you don’t need a translator to understand any terminology.

It’s an app literally built for the general public to learn more about their financial situation, and make the absolute best of it!

We wouldn’t recommend it if we didn’t love it. Considering the ease factor, it’s a no-brainer to get this app.

Once you get all of your accounts linked and set up your easy retirement plan, you can always do a FREE phone consultation with Personal Capital to dive into the information the algorithms provided, to create an even more personalized investment strategy!

You also get access to their blog, which will answer your complicated financial questions.

Learn about market volatility, retirement savings as a young adult, how finances change after marriage, investing account reviews, ways to increase your net worth, and so much more information that is priceless.

5. App and Desktop Design, Also for Apple Watch

As you can see in pictures throughout this post, the platform is easy to navigate and has a clean design!

Nothing is worse than getting a new app and not being able to find buttons, get back to where you started, etc. We’ve tried other applications before ultimately landing on Personal Capital, and unfortunately, other apps were not powerful on mobile.

One fun feature, for those of you with Apple watches, is the ability to keep track of your budget, spending, and accounts, straight from your wrist!

This feature is definitely something to consider if you are trying to stay strict to a budget and want to always know your balances.

(If you want a more robust experience, the desktop version has the most features!)

4. Be Confident with Retirement Planning

Want to know what you should invest in more, or what to buy next? Get ready to have charts, explanations, and assistance at your fingertips!

Really though, this feature is impressive.

We love how our investment suggestions and projections are based, not only on current investments, net worth, and our overall financial situation, but on age too.

When you initially open this tool on the app, you’ll have to answer some easy questions, including:

- Your current age and the age you hope to retire

- When you want to take out Social Security

- How much you currently earn per year

- How much you try to save each year in total

Make sure you have your accounts entered BEFORE having the service calculate your retirement planner! (it will give you more accurate information that way)

After a few more questions, the algorithms will run and calculate 5,000 possible simulations of your future financial situation, based on your spending, cashflow, indicated return of your investments, etc.

This is why it’s so important to have your bank accounts, investments, and other accounts linked before you start your retirement planning section of the app!

It will provide you an optimal projection and a median projection in graph form. It will then also show you:

- How much you are worth at the moment, and how much you’ve saved this year to date

- How much you should save per month

- The status of your current savings strategy (for example, it may show “You are in great shape for retirement.”)

- Suggestions of how to improve your retirement plan. This explains taxes, investing idle cash, and asset allocation. All important things!

3. Track Your Entire Portfolio

This app is perfect for anyone who wishes for a better financial future.

Meaning, if you plan to have investment accounts, the app will map it all out for you, unlike many other apps who focus mostly on basic cashflow.

Your portfolio is everything you have to your name that is tied with money.

This can include (but isn’t limited to):

- Cash

- Loans/mortgages

- Investment accounts (IRA, 401k, etc.)

- Long-term investments (stocks, bonds, mutual funds, etc.)

In addition, the budgeting tool is our favorite of all. Sounds simple enough, but it will keep track of everything for you including: how much of each category you spend (education, restaurants, groceries, travel, etc.), how much you spent this month in comparison to last month, and more.

You don’t even have to input ANYTHING!

By being linked to your bank accounts, it knows that Chipotle is a restaurant, and that school payments are for education. It then categorizes your transactions and informs you of the percentage of how each comprise your overall monthly spending. It’s honestly pretty impressive.

2. It Beats the Competition

If you are new to this whole “tracking money” thing, then there is nowhere else to look!

However, if you’ve looked into other options for tracking your money, you can check out these awesome comparisons between Personal Capital and it’s competitors!

As explained throughout this review, there are a ton of reasons why we think Personal Capital is a great option for you to track your net worth and investments.

One neat aspect of this app is that you can get two financial advisors who can help you create a strategy for your financial future.

You also get a FREE consultation of your investments and retirement planning after you’ve entered all your information.

Talk about the very thing we all need!

This will be extremely helpful for those of you who have limited knowledge with investing, and want to learn more about money management.

In addition, based on our research of their algorithms and strategies, they don’t take a “cookie cutter” approach. Meaning, the suggestions you receive based on your accounts will be entirely different that everyone else’s. It’s, literally, personal.

1. Discover Your Net Worth

Have you been too afraid to look your debt in the eye?

This is one of the biggest problems people have with their money!

Let’s be honest: it is scary to admit to your debt, loans, liabilities, and mortgages. No one likes to think they are in the negative with money.

You aren’t alone. However, it is important, if you want to plan for financial freedom, to rid of that debt. The very first step is by understanding how much debt you have to your name.

You’ll be far more motivated to pay off the money if you see it mapped out, graphed, charted, and explained, in comparison to ignoring it!

So, what is net worth?

Your net worth is literally how much money, whether cash or debt, you have to your name. This includes everything from cash in the bank, to stocks, to credit card debt and student loans.

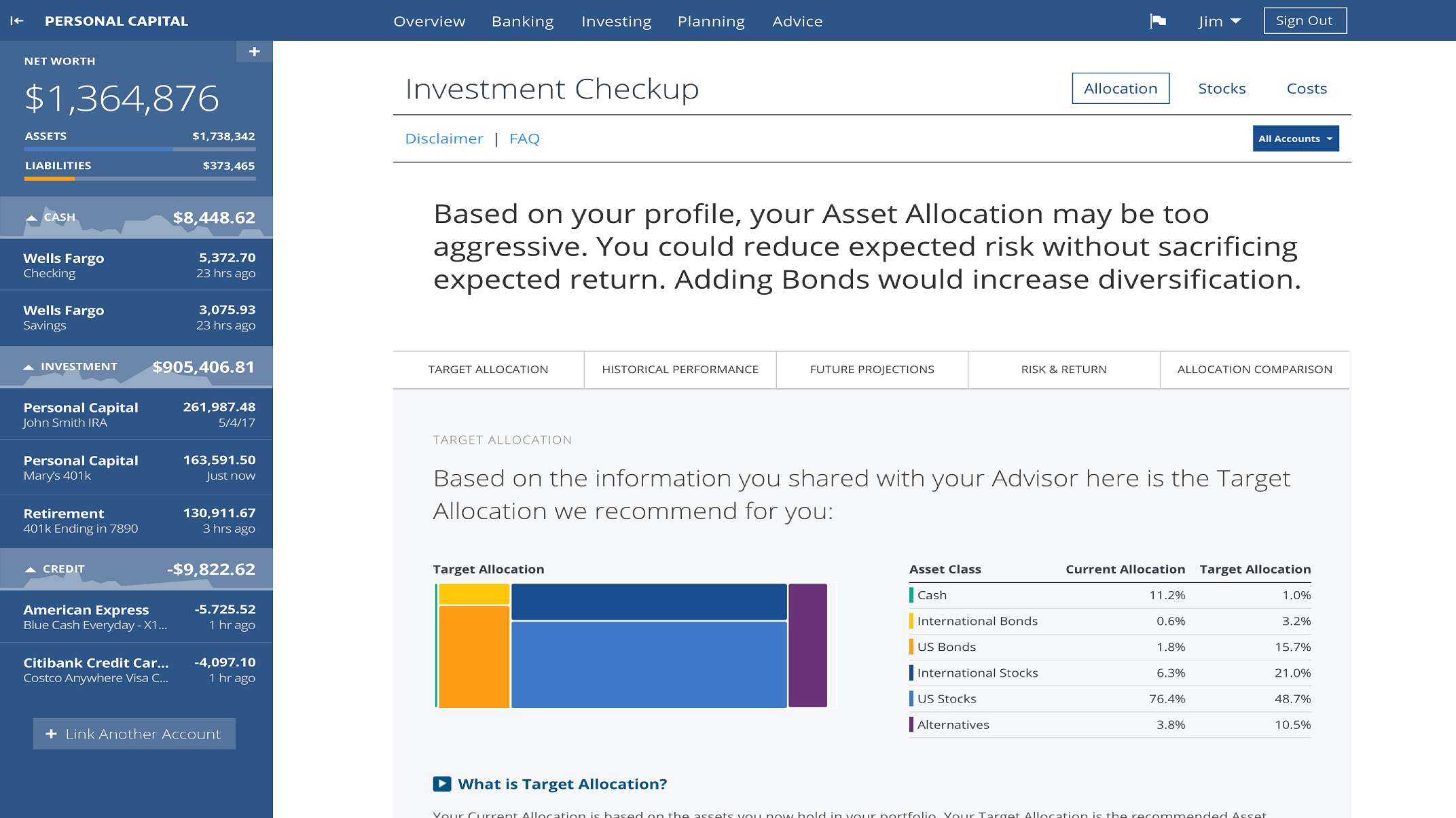

One feature that really helps with understanding your net worth is the “Investment Checkup”.

Don’t understand what your investments are doing or what you can invest in? Interested in improving your net worth? Don’t have any investments yet?

No worries! We love how this tool takes your spending history, cashflow, investments, and other information to devise a beginner-friendly explanation of what to do next!

You’ll get an in-depth look at:

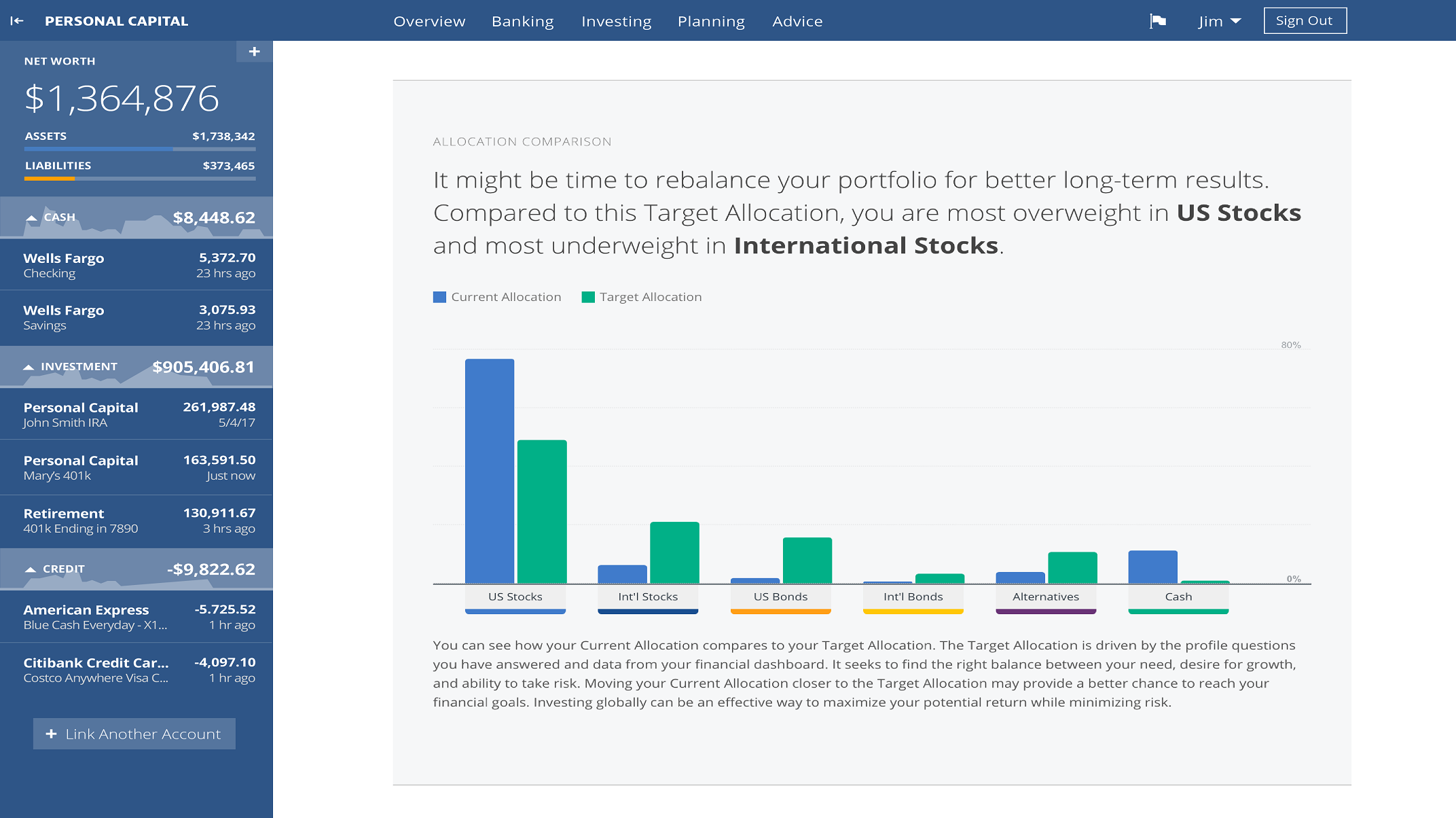

- Target Allocation – Where you should allocate your investments into. This includes stocks, bonds, and other ways to get you optimal expected return on your money.

- Historical Performance – How are your investments doing for you, and how have they been doing for the previous decades? Learn about inflation and your potential growth.

- Future Projections – Get a graph and explanation of your inflation-adjusted future scenario. Is your current asset allocation too aggressive?

- Allocation Comparison – You’ll see where your money is specifically placed. As in, you’ll see the percentages and information about where your investments are located. Do you have too much in stocks and not enough in alternate investments? This tab will give you the information to devise a future plan of where to put your money for optimal diversification.

How to Get Started:

Create an Account – Remember, the app and services are FREE!

You can go straight to the source and sign up today by clicking here!

The setup is extremely simple, and you can do it through both the desktop version or the app. Since it is free, it wouldn’t hurt to try it for a month, to see if you’d like it!

Link Your Accounts

This next step is easy, and usually takes only a click or two per account! And don’t worry, all of your information is safe!

Take a second to think about what all can add up to your overall net worth, as mentioned throughout this article.

This includes:

- Bank accounts

- Investments – 401k (or 403b), IRA’s, mutual funds, stocks, etc. If you have accounts with other services like Robinhood, these can be linked in one click as well!

- Credit cards

- Loans

- any other accounts you have, including assets and liabilities

Track Your Net Worth and Learn!

One of the best reasons we recommend this app is how much you can learn about your personal financial situation. You don’t have to have any background in finance to understand it!

Don’t be afraid to input your loans and debt! It is important to understand your full net worth to best plan for your financial future!

Let’s Summarize!

- We hope you enjoyed this in-depth look into what Personal Capital can provide you at this point in your financial journey! It is important to understand your net worth and have a good understanding of your future situation.

- Interested in this app but don’t like commitment? At least try it out for a month to learn more about your cashflow, spending, and build a budget based on everything you have learned!

Thanks for stopping by! Let’s keep learning!

All advice and opinions provided in this post are reflections on experience and are honest to help readers make decisions on their path to investing. Affiliates were used in this article. Please see our disclaimer page for more details.

This was a helpful review. I hadn’t heard of Personal Capital before, I have used Mint extensively. I am intrigued enough to check it out!

Thanks.