Disclosure: This post contains affiliate links. If you click through a link and make a purchase, it will earn me a small commission, at no additional cost to you! See our disclaimer for details.

Discovering your “financial Picture”

You’re beginning such an exciting path to more financial independence, better life fulfillment, less stress, and increased happiness!

You are on your way to financial freedom!

No matter how you started, whether with a popular book, by encountering a financial struggle, getting married, having a child, or even facing hardship like a foreclosure, you are interested in this “financial freedom” thing.

It can be overwhelming at first to figure out not only what to do, but what sources to utilize when just starting out!

Websites provide guidance, bloggers give advice and printables, there are endless books to purchase, expensive courses to take…it can be extremely difficult to figure out just where to start!

However, rest assured, we are here to hold your hand through the process. *insert sigh of relief*

After reading this article you should:

- Know the basics necessary to begin on your #debtfree journey

- Feel confident about what to expect to reach financial independence, AND…

- Discover the VERY FIRST thing to do to avoid feeling burnt out from the process!

What is #FinancialFreedom?

You may have either seen or hear of some of the following phrases and hashtags:

- #debtfree

- #financialindependence

- #financialfreedom

- #debtfreecommunity

There are plenty of others, but these are some of more popular phrases that can be found on social media such as Instagram.

The idea of financial freedom is reaching a point where you have paid off debt and have enough passive income, investments, and/or savings to be able to stop working and not worry about needing to work to pay bills.

Sounds nice, right?

Many think this is something that is only possible for millionaires, people with high earnings, or lottery winners.

Some may think this is impossible for them, since they have a low income, their family has never been wealthy, or even that they don’t have the education or skill to earn more.

Yet, once you realize the real women (and men, of course) who are achieving this awesome feat, you begin to open your eyes to how possible this can be for your life and family!

There are plenty of things to discuss and explore regarding this topic, but in this article, we still need to focus on the ONE, simple thing to do before venturing off into this journey!

Do THIS Before STARTING Your Financial Journey

Before you start saving money, looking up how to invest, begin throwing your money at student loans, or even pick up a personal finance book, you must first learn your net worth.

“Why?”, you ask.

- If you read a book that explains how to invest, how would you know how much of your income you could set aside without first understanding how your cash flow works?

- If you read blog posts about how to save money, how would you know much to save per month or year to achieve your financial goals?

- If you have a family, or plan to, how can you properly estimate how to achieve financial freedom without first knowing your assets, liabilities, and how much you actually are worth?

It can be scary to admit to yourself how much deb you have. You are not alone!

However, this is a critical step to take before you begin! By realizing the amount of credit card debt, student loans, etc. that you have under your name, it will help you tremendously in the long run.

Check your net worth here!

How Do I Find My Net Worth?

Long gone are the days of having binders with tables, check stubs, and payment calculations.

No worries, I know what you’re thinking. You would rather keep doing what you’re doing than EVER try to figure out your net worth.

Really though, for the majority of you, it would be torture to try to act like an accountant and balance your spending, income, liabilities, and investments by hand. No thanks!

Imagine: I have never had to put pen to paper to track net worth. Nor have I ever spent one penny on having someone else do it for me. It does not have to be hard, thanks to techonology!

(Plus, the easier it is, the more likely you’ll stick to the process!!)

So, how can I get started?

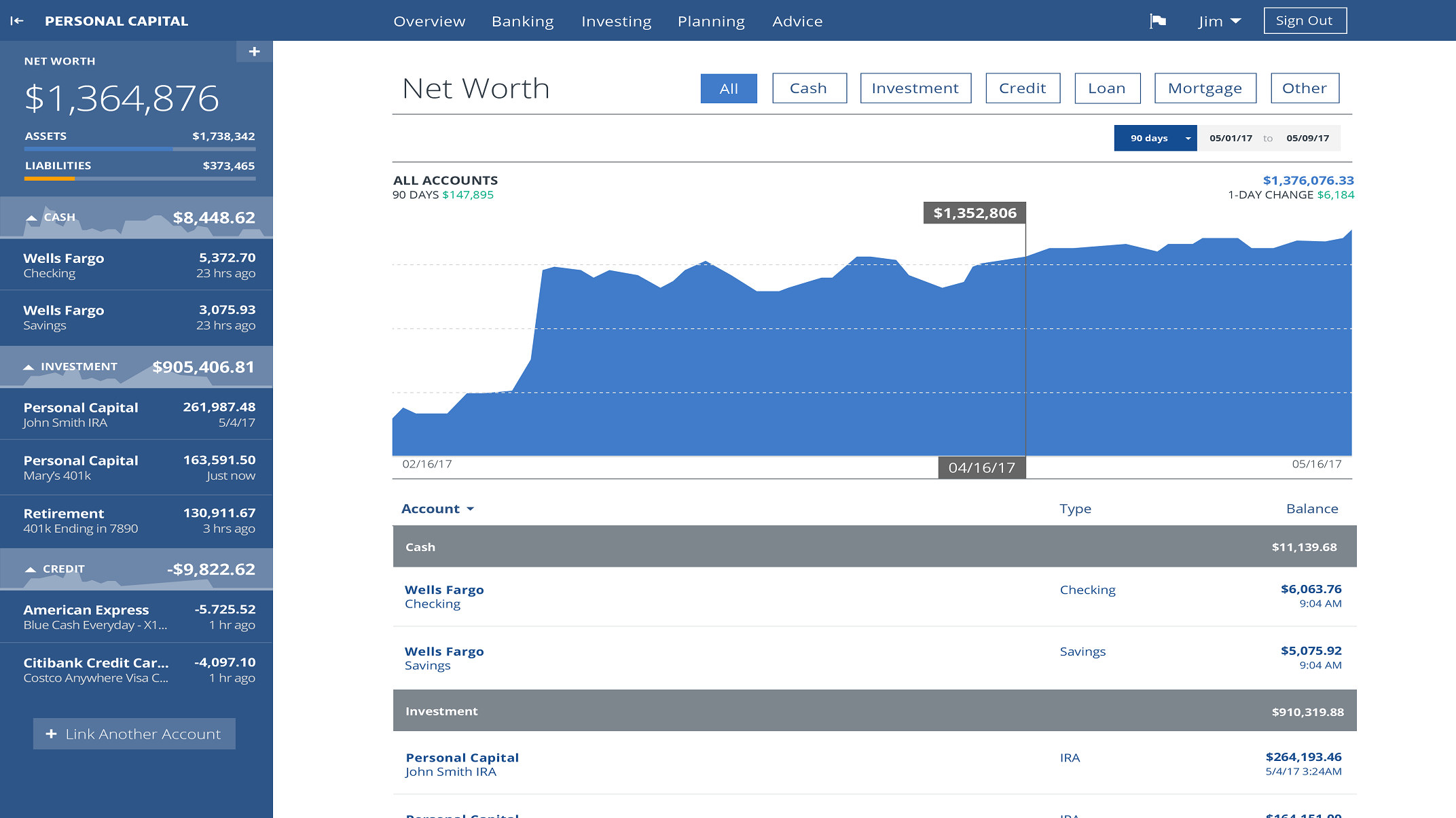

Personal Capital is a FREE app on your phone (and computer!) that will track EVERYTHING for you.

This includes (but is not limited to!):

- Credit cards

- Saving and bank accounts

- Cash flow

- Investment accounts

- Cash

- Retirement accounts

Not only is it free (seriously, there are NO gimmicks), but it will help you tremendously to get an idea of how to budget, understand your cash flow, and start thinking about saving for retirement.

Why get Personal Capital?

By using this app, you’ll visually see your income and debts, get advice on your investments, and be able to learn about your net worth.

By doing this FIRST, before setting off to learn about financial freedom, you’ll have an understanding about where you are at RIGHT NOW, and where you want to be.

There is no reason to not be tracking your net worth.

This tool is free, extremely easy to set up, and can help accelerate your path to your financial goals!

How Do I Get Started?

1. Download the app and start linking!

You can learn your net worth in a matter of minutes! Think about anything you have, like savings accounts and investment accounts. It takes just a few buttons to get all of these linked. Remember to also enter how much cash you have on hand, to add to your net worth!

(This software simply TRACKS your accounts. There is no money that you actually put into it. It is not any sort of money account.)

2. Check your net worth often!

It really makes everything more real when you face your debts. You’ll also begin to realize your assets, liabilities, and how to grow toward financial freedom.

You don’t need to track every day, but make a routine to check every month or every few months.

If you already own investment accounts, you’ll know that these don’t grow fast overnight. That’s why it isn’t realistic to check your net worth every day. However, if you check it every time you build your budget, it would be great to revisit how much you’ve paid off debt, and how much closer you’ve made it to financial freedom!

3. Make use of the free tools they offer!

This is one of the best parts of this app!

Not only can you see your cash flow, budgeting, and net worth through this app, you can also make use of the other awesome and free tools that are included!

Other free features include:

- Investment Checkup: learn about what investments may be best for your financial situation to make, including percentages, historical performance, risk, and future projection!

- Set budgets and get regular updates on your spending from month to month! (Super helpful when beginning your financial journey!)

- Track all of your transactions and visually see how you’ve performed as each day passes. You can also get notifications in your email and even on your smartwatch!

Okay, So Now What?

Once you’ve gotten all of your incomes, assets, liabilities, and savings accounts together, you can start planning!

How do your charts make you feel? Really, though! Many people are too afraid to even get to the part where you are at right now!

Understanding where you stand, financially, is critical to eliminating debt.

There are so many exciting things to look forward to, but it all starts with admitting reality.

Sure, you may have an unheard-of amount of debt. That is okay! If you have everything all in one place, you’ll get started on a good foot than if you purposefully didn’t think about your mortgage, student debt, credit cards, etc.

Trust me, tracking your money does NOT have to be hard. I’ve loved being able to open the app or pull up the website and see everything in one place, without having to do any math on my own.

Plus, it doesn’t cost anything, which is amazing for such a tool.

Let’s Summarize!

- You can’t stay on track to financial freedom without understanding your current financial situation. It all starts with checking your net worth. Seriously, it is so much easier than you’d think!

- The journey to financial independence is extremely rewarding, but you must take the right steps to avoid burn out. Why not make it easier by using an app that is both FREE and easy to use?

All advice and opinions provided in this post are reflections on experience and are for educational and entertainment purposes only. Please see our disclaimer page details.