If you’re looking for an easy money challenge to do in 2022, this 52-week savings challenge is the perfect one to try!

The reason this money challenge is so popular is that it is easy to remember how much money to set aside each week. Plus, there is a reverse version of this savings challenge that is a great option if you need more motivation!

This article will outline how to successfully follow this year-long money challenge and how to have success!

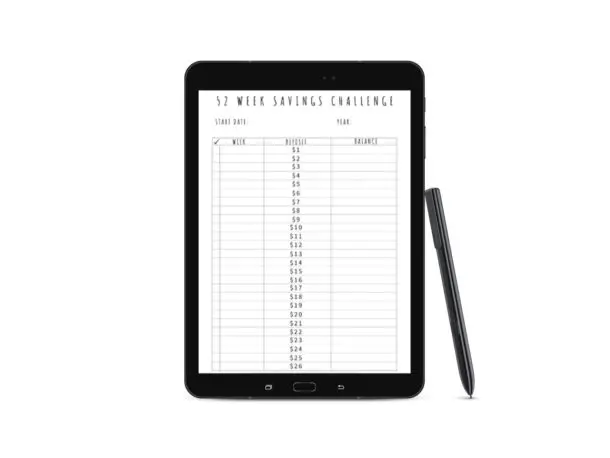

This table shows you how much money to set aside each week for the 52-week money challenge:

| Week 1 | $1 | Week 14 | $14 | Week 27 | $27 | Week 40 | $40 |

| Week 2 | $2 | Week 15 | $15 | Week 28 | $28 | Week 41 | $41 |

| Week 3 | $3 | Week 16 | $16 | Week 29 | $29 | Week 42 | $42 |

| Week 4 | $4 | Week 17 | $17 | Week 30 | $30 | Week 43 | $43 |

| Week 5 | $5 | Week 18 | $18 | Week 31 | $31 | Week 44 | $44 |

| Week 6 | $6 | Week 19 | $19 | Week 32 | $32 | Week 45 | $45 |

| Week 7 | $7 | Week 20 | $20 | Week 33 | $33 | Week 46 | $46 |

| Week 8 | $8 | Week 21 | $21 | Week 34 | $34 | Week 47 | $47 |

| Week 9 | $9 | Week 22 | $22 | Week 35 | $35 | Week 48 | $48 |

| Week 10 | $10 | Week 23 | $23 | Week 36 | $36 | Week 49 | $49 |

| Week 11 | $11 | Week 24 | $24 | Week 37 | $37 | Week 50 | $50 |

| Week 12 | $12 | Week 25 | $25 | Week 38 | $38 | Week 51 | $51 |

| Week 13 | $13 | Week 26 | $26 | Week 39 | $39 | Week 52 | $52 |

1. Find Your Why

The first place to start when beginning this money challenge is to think about why you are even doing this money challenge!

Why do you need a little over $1300? For you, it may be to pay for a car down payment or save up for a small vacation.

Before beginning any money challenge this step is essential. The reason is that money challenges are notorious for not being finished or completed, so if you are able to stay on track for a full year, then you have a solid “why”!

There are many ways to remind yourself of your “why”. You can create a phone wallpaper of a vision board, write down your goals, or even make a Vivid Vision. Having your “why” written down and someplace that will regularly remind you of your purpose for saving money is important!

2. How to Do the 52 Week Money Challenge

To do this savings challenge, you will set aside money once a week.

This can be done by transferring money into your savings account, into a money jar, or even into envelopes.

This money challenge is easy to remember how much to set aside each week: Set aside the amount per week that it is that week of the year.

In simpler terms, if it is week one you would put away $1. On week two put aside $2.00. Save $3 on week three.

The part that can be tricky is when it starts getting to be more than $20 a week. Most people would have a difficult time finding $40 a week and setting it aside. By the end of the year you will be saving $50, $51, $52 dollars, and that may become a challenge!

Pssst: If you are interested in using envelopes for more than this money challenge, check out this fun envelope savings challenge!

Tip #1: You do NOT have to start this 52-week money challenge on the first week of the year! You will see in the downloadable PDF that the “Week” is blank for you to fill in each week. The first week you begin can be week #1.

Tip #2: If you choose to not download the FREE printable, screenshot the table above and put it in your phone’s saved folder to remember this money challenge!

3. The Reverse 52 Week Money Challenge

One great reason this year-long money savings challenge is popular is that it can be done in reverse!

The “Reverse” method is more popular than the original version. Why? I want you to think about your behavior around saving money. If you start this challenge and begin it with the low numbers ($1, $2, $3…), that would be really easy at first. Over time the money challenge increasingly gets more difficult.

If the challenge becomes more difficult, it becomes much less likely that you are going to finish the money savings challenge!

The reverse savings challenge works by reversing the amounts that you deposit every week!

On week one you would set aside $52 dollars. Week two would be $51 dollars. Week three would be $50, and so forth.

This option may be easier for some of you who will dedicate yourself to this money challenge because you would actually get the hard part done first and as you go throughout the year, each week actually gets easier and easier!

4. Tips for Success With This Money Challenge

- Get your family and spouse on board

If you are going to be setting aside money every week, it is important that your family understands what you are doing and why you are doing it! Many people say that making money challenges a family game or competition also increases motivation.

- Find ways to stay motivated!

As I mentioned earlier in this article, it is very common for people to give up early when doing a money challenge of any kind. I encourage you to spend just a small bit of time to find YouTubers, podcasts, printables (like the one on this page!), and other ways to keep yourself on track!

Summary

This 52-week money savings challenge is an easy way to save up $1378 in 1 year without much effort!

You can do this savings challenge by putting aside money one time a week. It also can be reversed if you think it would help you stay dedicated to the money challenge!

If you want to learn more about money challenges, check out my YouTube channel for dozens of videos about how to save money, budgeting, and more money challenges!