Disclosure: This post may contain affiliate links that earn me a small commission, at no additional cost to you! See our disclaimer for details.

What is the $30 Millionaire Challenge?

The $30 million millionaire challenge is an up-and-coming money challenge that consists of saving $30 a week and investing $30 for 30 years. By the end of the 30 years the investments will have grown to over $1,000,000.

This money challenge requires discipline, delayed gratification, and diligence. This is more than just saving $30 a week for a year. The millionaire challenge requires you to save $30 week for 30 straight years!

Why Do this Money Challenge?

I am always down for a new money challenge! I have tried multiple money challenges, with one of my most popular ones being The 365 Day Nickel Challenge, which you can learn about here!

I also have done The Envelope Stuffing Money Challenge, to save over $5000 in a year.

Money challenges help you to stay motivated and are fun to include the entire family. You learn how to get creative and you can set a reward for the end of the challenge to make it worthwhile!

However, this $30 money challenge is a bit different. Most money challenges last a month, six months, or one year. This money challenge lasts 30 years.

So, the question is, why do this money challenge?

The $30 millionaire money challenge has a very different purpose and can help you to learn how to invest, save, and get creative with your money! It becomes less of a challenge and more of a habit, or a routine.

But the biggest reason is that you can compound your money into a significant chunk of change over the decades!

In fact, over 30 years, you could retire with anywhere from $500,000 to over $1,000,000 in your investment accounts!

(This number was derived from researching stock growth and learning from other popular investors. Do note that investing is never a guarantee.)

In this article you will learn how to live on less money each week, how to find more money in your life, what investing apps I recommend in order to invest your $30 a week, and the mindset you need to have in order to become a millionaire in 30 years!

How Much is $30 a Week for a Year?

If you want to start the $30 millionaire challenge, it is important to realize how much $30 a week is for a month and how much this equates to in a year. In order to prepare your budget for this challenge, you will need to know these numbers so you can set aside the correct amount each week, or month, and be aware of how much it will cost you over 12 months.

- $30 a week for a month equates to $120.00 each month.

- $30 a week for a year (52 weeks) equates to $1,560 dollars a year.

What to Do with $30 a Week

One critical component of doing the $30 money challenge is to have an established budget.

Having a budget is so important to track your income and expenses, and to be able to set aside the $30 you need to do this challenge every week.

In order to track my income, expenses, net worth, and retirement accounts I use a free app on my phone an on my computer called Personal Capital.

I highly recommend getting a money tracker like this free app so you can frequently check how much your money is growing and this can encourage others to save and invest as well!

We need to discuss what to do with your $30 a week.

The key of the $30 millionaire challenge is to take $30 a week and invest it. Since I am not a financial advisor, CPA, etc., I cannot give any specific investing advice. However, here are a few tips:

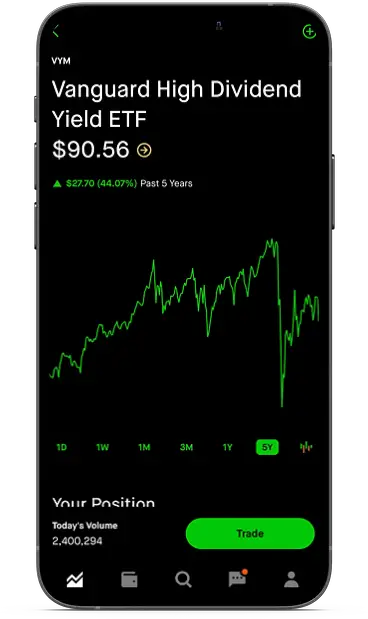

- Investing in index funds are a low cost, lower risk investing option

- Take advantage of investing apps that provide you with free stocks or free cash to sign up to learn how stock investing works

- Do research to figure out what form of investing you would prefer. There are so many ways to invest and types of accounts to use, and each type serves a different purpose and is for a different type of person

To figure out where you would specifically like to put your money, I recommend you checking out my two favorite investing books for beginners.

- The Simple Path to Wealth is a popular for anyone who wants to put as little effort as possible into investing. The focus is investing in index funds , like VTSAX, and this book thoroughly goes over how to do it.

- Unshakable by Tony Robbins is a little more advanced, but expertly goes through how to diversify your investments and how to build an investment portfolio overtime.

How to Invest $30 a Week

As stated before in this article, the point of the $30 millionaire challenge is to invest $30 a week.

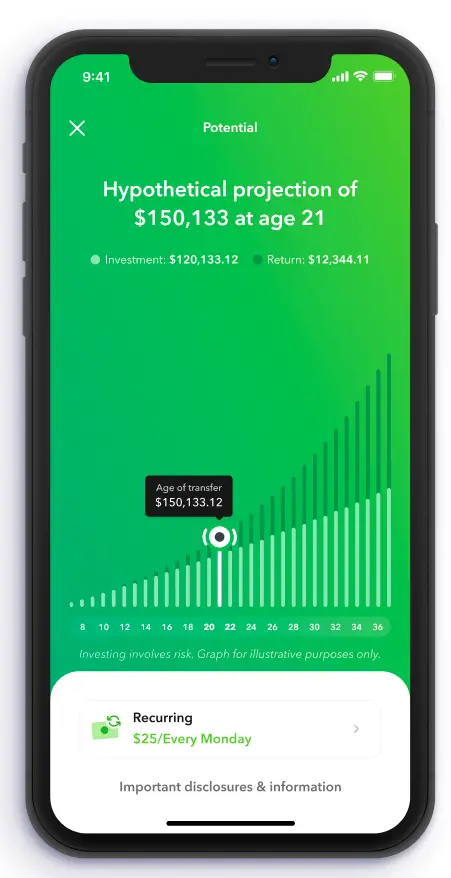

By doing this, in 20 years you could have anywhere from 150,000 to almost $300,000, and after 30 years you could have approximately $1,000,000.

Bonus points if you are able to save $40.00, $50.00, or even $70.00 a week!

The easiest way that I have found to invest frequently like this is to use a micro investing app. In the section below I will go over different micro investing apps.

In short, microinvesting involves spending very little money to purchase single stocks or fractions of shares.

This puts your investing right in your hands, without the need to regularly meet in with a financial advisor or without the requirement of investing thousands of dollars at a time.

Nowadays, to do this, all you need is to sign up for a free account online! Let us dive in to how to do this!

(Note that it is always recommended to meet with a financial advisor or similar financial personnel when it comes to investing. It is always important to not throw your money into things you don’t understand.)

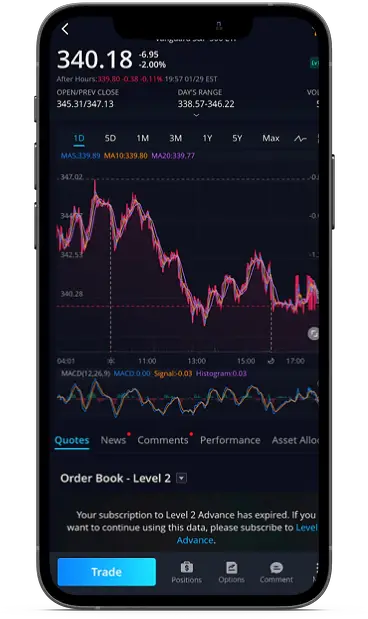

Webull

The Webull platform offers a more technical in detail-rich investing experience. It also offers more stock options than other popular investing aps, which can be a big decision maker for those of you who want to grow in your investing skills over time!

- Unlike other investing platforms, Webull offers a much larger incentive to sign up. Instead of just getting one stock, you can typically get up to 9 stocks, which are valued up to $1,400 (compared to Robinhood, which typically is in the $3 range per free stock).

- Webull offers expanded hours for trading, allowing you to buy and sell after the market, which is not offered in the other apps.

- They also provide an amazing free computer software that provides you far more technical information about your investments than any of the other apps.

Robinhood

Robinhood is considered one of the most popular micro investing apps. It has grown to be in leader in mobile investing and it is free to download and free to use. The bonus with this is that you can get a free stock through this link in order to watch and learn how the stock market works.

- Robinhood is a great app for both beginner and intermediate investors. They offer enough information without it getting overwhelming for anyone new to investing.

- They also have a good referral program, allowing you to earn more free stocks if your friends sign up.

- Robinhood also has the opportunity to learn more technical features by joining a membership that costs $5 a month, if you end up becoming more of an intermediate or advanced investor.

Acorns

Acorns does cost $1.00 month in order to use their investing service, but they have made themselves known for making the whole “saving and investing” process as easy as ever! Acorns is now considered the best app for millennials and young adults to begin investing for their future.

- Acorns is a great option if you want to put in as little prior knowledge and research as possible.

- Acorns platform is also very beautiful layout and is very easy to navigate. They also have great customer service, which is always a plus!

- This app can automatically invest any amount into your savings or investing account, and can help you save cash on daily purchases, too!

How to Live on Less

A main component to the $30 a Week Money Challenge is to learn how to live on less! Let’s go through a few tips to help you save $30 a week.

RELATED ARTICLE: 3 Budget Hacks You Need to Start Today to Save Hundreds Each Month

Food on a Budget

The food category of your budget most likely takes up a huge chunk of your monthly cash.

- Shop at stores like Aldi, compared to higher-end grocers like Whole Foods

- Meal prep whenever possible by doubling your recipes and storing the food for lunches and dinners

- Stop eating out so much! It isn’t healthy and it isn’t great for your budget, either

- Avoid sugar. It contributes to an unhealthy diet and makes you more hungry

Use Surveys to Get Extra Cash

I started using survey sites awhile back and have earned dozens of PayPal cash payouts and gift cards over a decade ago since high school. No joke, this works, but it takes some time to accumulate. Check out my two favorite survey sites below!

I know of people who use dozens of survey sites, but I only stick to two. (With a full-time job, a YouTube channel and a website, I don’t have time to use a ton of apps!). But hey, if you want to double your earnings, check these both out!!

Here is a step-by-step article here about how to start with Survey Junkie!

This method may not be super quick at giving you free cash, but it is definitely helpful for earning money in order over time!

Use Cash

Using cash is a great way to avoid overspending, and allow you to save more money – and thus, invest more each week!

I recommend you check out [this detailed article I wrote about the Dave Ramsey Envelope Method to learn more! This method has been proven to have helped thousands of people achieve their personal finance goals.

How to Succeed at the Millionaire Challenge

Get the Family on Board

I always advocate for getting your family on board with any money challenge that you do!

This can help educate your kids how to save money and teach them the concept of delayed gratification. This is especially important to get your spouse on board considering you’ll need to find an extra $30 a week to set aside an investment accounts.

Have an Accountability Partner

If you do not have an accountability partner you need to get one right now!

An accountability partner is an individual, like your spouse, a close friend, or a family member, who helps be your motivation through your financial journey. You typically meet with them once a month or every so often in order to review your successes, failures, and goals.

Consistency is Key

Staying consistent is the most important part of any money challenge, especially the $30 a week millionaire challenge!

with any new habit you bring into your life, you’re most likely to be successful at the beginning and slowly slip away as time goes on. Even if you don’t remember to invest one week, or if you aren’t able to set aside exactly $30 or more, the idea here is to be consistent.

Do you at least have $5 that you could invest, or, could you invest $60.00 in the next week since you missed out on a week. Remember that it is more important to be consistent, not to be perfect!

Summary

The $30 millionaire challenge is a money challenge that encourages you to set aside $30 a week over the span of 30 years, in order to achieve millionaire status after 30 years.

If you are able to set aside more money than $30 a week, you can grow that number even more, or, have $1,000,000 in invested assets even sooner!

There are multiple investing avenues in micro investing apps that you could use in order to invest $30 a week. Each investing platform has its pros and cons and it is encouraged that you explore multiple ones before officially settling down with one.